Daily Insights on Global Commodities Markets and Events | Commodity Trader | Founder of The Merchant (40k subs) 3x/week → themerchantsnews.substack.co…

Joined August 2024

- Tweets 5,078

- Following 302

- Followers 19,862

- Likes 2,263

🚨 Venezuela Oil Export Up 60% In 30 Days

🛢️800,000 bpd Is Back.

This Is A Heavy Crude Shift.

January 2026 exports jumped from 500,000 bpd to 800,000 bpd.

That changes Gulf Coast economics.

⚠️ Why This Matters?

US Gulf Coast refineries were built for Venezuelan heavy crude.

• Venezuela is 30–40% closer than Canada

• Merey trades $6.50/bbl cheaper than WCS(canadian)

• Same refineries, Better margins

Up to 740,000 bpd of Canadian heavy into PADD 3 is now contestable.

That’s roughly $20B in annual revenue at risk.

300–400 kb/d could face structural pressure by 2027–28.

⚙️ The Trade Most Investors Miss

Before Venezuela ramps production, it needs equipment.

Drill pipe, Casing, Rig upgrades, Offshore systems.

Over the next 5–7 years:

$7.5–12B in equipment spending.

They get paid first.

No PDVSA payment risk.

No labor risk.

Just hardware sold to Western majors.

This isn’t about who drills in Venezuela. It’s about who supplies the tools.

The heavy crude battle has started.

Full deep dive in my latest newsletter👇

open.substack.com/pub/themer…

#oott #Venezuela #Canada #energy

4

15

50

7,275

🥇 Russia’s Gold Holdings Slip as Prices Hit Records

Russia’s central bank gold reserves just dropped to ~74.5m ounces.

Small in absolute terms.

But timing matters.

Gold is at record highs.

Moscow trims holdings.

Why?

• Liquidity needs under sanctions?

• Portfolio rebalancing?

• FX management via gold monetization?

Russia has been a structural gold buyer for years.

A reversal, even modest, raises questions.

When prices spike and a sanctioned central bank reduces holdings, it’s rarely random.

Watch flows, not headlines.

#Russia #gold

2

8

25

2,139

Smaller

Lower grade

Harder to permit

That’s the reality of most new copper discoveries compared to giants like Collahuasi and Escondida.

But supply isn’t dead.

Undeveloped projects exist. What’s needed is faster permitting, political clarity, and capital willing to move before the deficit hits.

For copper exposure:

• McEwen Mining Inc. | TSX:MUX

• Foran Mining Corporation | TSX:FOM

• ATEX Resources Inc. | TSXV:ATX

Source: S&P Global Market Intelligence

#copper #Energy #mining

2

12

799

🛢️ Brent 18% YTD

$7–10/bbl of that is Iran war premium.

The glut was supposed to push Brent into the $50s.

Instead it’s above $72. Strongest start since 2022.

This isn’t just fundamentals.

It’s geopolitical insurance.

Why the surplus didn’t show up:

• Kazakhstan & Libya outages

• US winter disruptions

• Sanctioned Russian/Iranian barrels stranded

• China absorbing excess

Visible stocks feel tight.

Pricing hubs feel tight.

Options confirm it.

Record call volumes.

High implied volatility.

Upside skew near post-strike levels.

Without Iran risk, Brent likely trades low-60s.

But:

• US signaling new strikes

• Naval buildup in the Gulf

• Hormuz back in focus

If Iranian exports are hit.

If Hormuz is disrupted.

$10 premium becomes $20 .

Markets don’t price total supply.

They price accessible barrels.

And when 20% of global flows pass through a chokepoint near conflict, insurance is embedded in the curve.

#Brent #WTI #oott #energy

11

12

103

7,295

📊 Top 10 African Economies (1980 → 2026)

The growth is structural.

🇿🇦 South Africa $445B

🇪🇬 Egypt $399B

🇳🇬 Nigeria $354B

🇩🇿 Algeria $285B

But this isn’t just GDP.

It’s resource leverage.

Africa holds:

🛢 Major oil & gas reserves. Nigeria, Algeria, Angola

🥇 Gold. Ghana, South Africa

🔋 Copper & cobalt. DRC

⚛️ Uranium. Namibia, Niger

🧱 Phosphates. Morocco

🪨 Lithium & critical minerals emerging

GDP growth resource abundance = export power.

The next decade isn’t just about consumption growth.

It’s about who monetizes commodities into infrastructure, refining, and value-added exports.

Africa is not short resources.

The question is execution.

#oott #metals #energy #Africa

1

21

70

2,976

🚨 Iran–US Nuclear Talks Shift

Iran says the US accepted its red line: enrichment continues.

Talks now focus on:

• Level of enrichment

• Centrifuge numbers

• Facility locations

No full dismantlement.

But here’s the backdrop.

If diplomacy fails, the US doesn’t need Gulf bases.

Long-range strikes. Tanker bridges. Carrier groups. B-2s.

The military option exists.

Now the market watches which path wins.

source : aitelli

#Iran

6

2

12

2,601

🚨 Venezuela Oil Exports 60% In 30 Days

From 500 kb/d to 800 kb/d in January 2026.

This is a heavy crude shift.

Why it matters:

🛢️ US Gulf Coast refineries were built for Venezuelan barrels

📉 Merey trades ~$6.50/bbl below WCS

📍 30–40% shorter route than Canada

Up to 740 kb/d of Canadian heavy into PADD 3 is now contestable.

~$20B in revenue at stake.

But the real trade?

Before production ramps, Venezuela needs equipment.

$7.5–12B in hardware over the next 5–7 years.

This isn’t about who drills.

It’s about who supplies.

Full breakdown, risks, and positioning in my latest newsletter 👇

themerchantsnews.substack.co…

#oott #Canada #Venezuela

Feb 20

🚨 Venezuela Oil Export Up 60% In 30 Days

🛢️800,000 bpd Is Back.

This Is A Heavy Crude Shift.

January 2026 exports jumped from 500,000 bpd to 800,000 bpd.

That changes Gulf Coast economics.

⚠️ Why This Matters?

US Gulf Coast refineries were built for Venezuelan heavy crude.

• Venezuela is 30–40% closer than Canada

• Merey trades $6.50/bbl cheaper than WCS(canadian)

• Same refineries, Better margins

Up to 740,000 bpd of Canadian heavy into PADD 3 is now contestable.

That’s roughly $20B in annual revenue at risk.

300–400 kb/d could face structural pressure by 2027–28.

⚙️ The Trade Most Investors Miss

Before Venezuela ramps production, it needs equipment.

Drill pipe, Casing, Rig upgrades, Offshore systems.

Over the next 5–7 years:

$7.5–12B in equipment spending.

They get paid first.

No PDVSA payment risk.

No labor risk.

Just hardware sold to Western majors.

This isn’t about who drills in Venezuela. It’s about who supplies the tools.

The heavy crude battle has started.

Full deep dive in my latest newsletter👇

open.substack.com/pub/themer…

#oott #Venezuela #Canada #energy

4

9

52

3,601

🇨🇦 Canada is pivoting to Asia

With TMX, Alberta heavy crude now flows to the Pacific not just the US

Before TMX: 90% of exports went south.

Now: Asia is a growing outlet.

🇺🇸 The US Gulf Coast wants Venezuelan heavy back.

🇨🇦 Canada is diversifying away from that risk.

Energy trade routes are shifting.

Pipes decide leverage.

Full deep dive in my latest newsletter👇 open.substack.com/pub/themer…

#Canada #Venezuela #oott

35

34

205

13,030

🚢 How an LNG Terminal Turns Liquid Back Into Gas

LNG arrives at –162°C.

Stored as a cryogenic liquid.

Then converted back into pipeline gas.

1️⃣ Unloading

LNG carriers connect via loading arms.

Liquid moves to insulated storage tanks.

2️⃣ Storage & Boil-Off Gas (BOG)

Some LNG naturally vaporizes.

That gas is captured and reused. No waste. No flare under normal conditions.

3️⃣ Regasification

High-pressure pumps send LNG to vaporizers.

Seawater or heat exchangers warm it.

Liquid becomes gas.

4️⃣ Send-Out

Gas is metered, pressure-adjusted, and injected into the grid.

What matters:

• Massive capital intensity

• Cryogenic engineering

• Energy security infrastructure

• Strategic control over import flows

LNG terminals are not just industrial sites.

They are geopolitical gateways.

#energy #LNG #NaturalGas #oott

9

94

333

11,901

Bigger Than Countries💥

The Trading Houses Moving 2 Billion Tonnes of #Commodities

When people talk about commodities, they often picture producers.

Saudi aramco, Rio Tinto, ExxonMobil and Shell.

But the system runs on a different layer.

Merchants!

The firms that finance, store, blend, insure, hedge, and physically deliver the world’s commodities.

These firms are the shock absorbers of the commodity system.

When markets break (wars, sanctions, droughts, refinery outages) they reroute flows and keep supply moving.

The next time you see a commodity price spike, ask a different question.

Which trader is holding the barrels, the ships, and the inventory when everyone else panics?

#oott #energy #metals

4

82

260

23,861

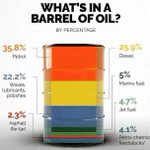

🛢️ What’s REALLY inside a barrel of oil?

It’s not just fuel it’s the lifeblood of modern economies.

📊 Here’s the breakdown:

• 35.8% Petrol

• 25.9% Diesel

• 22.2% Waxes, lubricants & polishes

• 5% Marine fuel

• 4.7% Jet fuel

• 4.1% Petrochemical feedstocks

• 2.3% Asphalt (tar)

🚨 What does this mean for global markets?

Oil isn’t just powering cars and planes it’s in supply chains, plastics, packaging, fertilizers, roads, and manufacturing.

📦 Now connect this to China:

🇨🇳 #1 oil importer

🇨🇳 #1 exporter of goods ($3.38T in 2023)

🇨🇳 #1 buyer of Iran’s crude (89%)

China’s trade dominance is built on oil barrels not just semiconductors and steel.

🌍 Geopolitical Insight:

Every barrel shipped isn’t just energy it’s leverage.

From lubricating machines to fueling ships, oil drives hard power, soft power, and market power.

🔑 In an energy transition world, understanding what’s inside a barrel tells you who holds the steering wheel of global trade.

#oott

10

164

436

10,910

📊 Commodities Are Tiny

That’s The Opportunity

Look at the scale:

• US Equities: $72T

• US Treasuries: $25T

Now compare:

• Oil open interest: $549B

• #Gold: $199B

• #Copper: $190B

• #Silver: $51B

Most commodity markets are sub-$500B.

That means something important.

It doesn’t take massive capital flows to move prices.

A small reallocation from bonds or equities into #commodities can create outsized price impact.

In a world of:

• #Energy transition

• Re-industrialization

• Geopolitical fragmentation

• Supply constraints

The asset class is structurally small relative to financial markets.

#oott

26

68

3,088

🌍 Africa Is a Commodity Superpower

North Africa: petroleum & gas.

West Africa: oil, gold, iron ore.

Central Africa: diamonds, cobalt, copper.

East Africa: gold, uranium, natural gas.

Southern Africa: platinum, coal, manganese, diamonds.

It is the backbone of:

• #Energy

• Fertilizers

• EV batteries

• Defense metals

• Precious metals

Cobalt. Uranium. Platinum. #Copper. #Gold. Oil.

In a fragmented world, supply chains run through #Africa.

who secures long-term access first?

7

33

92

3,023

🔥 The US could secure a 60-day stockpile of key battery minerals for under $1 billion.

Total cost in 2026: $991 million

Breakdown:

• Lithium: $416m

• Nickel: $272m

• Cobalt: $255m

• Others (graphite, manganese, coke): marginal

In the context of a $27T economy…

#Energy transition security for less than $1B.

That’s not a cost problem.

That’s a policy choice.

If supply chains are strategic, why aren’t we building buffers now?

#battery #minerals

3

11

35

1,512

🚨 20% Of Global Oil Flows Through One Narrow Strait.

Iran’s Drills Put Hormuz Back In Focus.

Roughly 1 in every 5 barrels consumed globally passes through the Strait of Hormuz.

Now Iran’s latest military drills in the area are reminding markets how concentrated global energy flows really are.

🌍 The Strait of Hormuz connects the Persian Gulf to global markets.

It is the export artery for:

• Saudi Arabia

• UAE

• Kuwait

• Iraq

• Qatar

• #Iran

A similar share of LNG exports, especially from Qatar, also transits the strait.

There is no easy replacement route for most of those barrels.

🛢️ The strait has never been fully closed.

But every escalation involving Iran immediately triggers:

• Higher insurance premiums

• Shipping risk repricing

• Oil risk premium

Even the threat of disruption can lift prices several dollars per barrel.

A sustained interruption could cause a much sharper spike, especially if tankers or export terminals are targeted.

#oott

2

22

82

6,519

🇧🇷 Petrobras Looking at Venezuela🇻🇪

Petrobras will assess opportunities in neighboring Venezuela, according to its head of Exploration & Production.

No commitments yet. Just evaluation.

Venezuela holds large untapped reserves, but risks remain:

• Political and regulatory uncertainty

• Environmental liabilities

• Infrastructure degradation

This signals something bigger.

Regional majors are repositioning as Venezuela reopens.

Capital is watching Caracas again.

#oott #Brazil #Venezuela

2

11

49

2,196

🇩🇪 Berlin Tightens Control Over Rosneft’s German Assets

The European Commission has approved a new trusteeship structure that formalizes Germany’s long-term control over Rosneft’s German operations.

This locks in Berlin’s oversight of key refining assets, including facilities that supply fuel to eastern Germany and Berlin.

The move shifts Rosneft’s role from owner-operator to effectively sidelined shareholder under state supervision.

It is part of a broader strategy to structurally remove Russian influence from critical European energy infrastructure.

#Energy security is no longer theoretical in Europe.

It is legal architecture.

#oott #Russia

1

9

21

1,234

⚡ Cuba Without Oil

Power Collapses

When oil deliveries stop, electricity supply falls.

Daily available power dropped sharply once crude inflows dried up.

Generation slipped from ~1,450 MW toward ~1,200 MW in weeks.

Cuba’s grid is oil-dependent.

No barrels. No baseload.

This is what energy insecurity looks like in real time.

Oil is not just export revenue.

It is grid stability.

#oott #Cuba

4

10

21

1,362

🌍 Africa’s Baseload Reality

This map tells the real story of African power.

North Africa: Gas-to-power anchored to large reserves.

West Africa:Gas corridor forming around offshore discoveries.

East Africa: Hydro geothermal backbone emerging.

Southern Africa: Coal-heavy. Aging fleet. Limited diversification.

Hydropower potential remains largely untapped.

Gas is expanding.

Nuclear is minimal.

Africa holds resources.

But firm baseload infrastructure is uneven and fragmented.

The opportunity is not just generation.

It is grid integration, gas monetization, and cross-border power corridors.

#oott #gas #Africa

5

30

79

2,401

🇺🇸The US now imports nearly all the uranium its reactors use☢️

Domestic production has collapsed. Imports dominate.

Now add this:

Every advanced reactor western nuclear facility Runs on HALEU.

Until 2023, only Russia could produce it commercially.

Today, just one Western company is licensed to do so.

The nuclear renaissance is not about reactors.

It’s about fuel control.

👇 Full breakdown in my latest article

open.substack.com/pub/themer…

#energy #nuclear #uranium

2

6

26

1,542